N26 Real-time banking

Instant payments and money transfers

Need to pay or get paid ASAP? Send and receive instant bank transfers 24/7, and top up your account in seconds. Plus, enjoy free instant money transfers between N26 friends with MoneyBeam.

MoneyBeam—free instant payments

Forget waiting to be paid back, or typing in tricky bank details. With N26 MoneyBeam, you can instantly request, receive, and send money to your N26 friends at lightning speed.

Add new N26 friends with just an email or phone number, and MoneyBeam them on the spot.

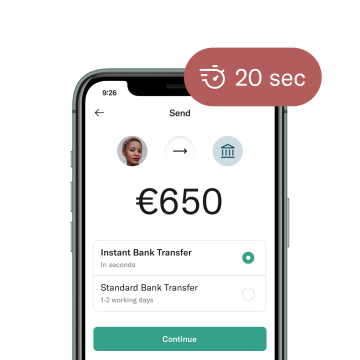

Instant bank transfers

Pay and get paid in seconds, not days. Need to settle an urgent bill on the weekend? Instant bank transfers work 24/7, so your money will arrive immediately to a bank account in the SEPA area—even if it’s not an N26 account.

Best of all, sending and receiving instant bank transfers is 100% free for premium customers, and only costs €0.99 to send for N26 Standard customers. No delays. No waiting. No problem.

Top up your account instantly

Ready to get started with N26 right away? After signing up, instantly top up your account with your debit or credit card, Apple Pay, or Google Pay and start spending immediately—even before your card arrives in the mail.

Get instant money transfers with N26

Join 8 million customers worldwide, and easily make instant payments from anywhere, anytime. Compare N26 bank accounts now and sign up online in minutes, directly from your smartphone—no paperwork needed!

FAQs

What is an instant payment?

An instant payment is a type of money transfer from one bank to another that’s complete in a matter of seconds, rather than a few business days. Instant payments are available 24/7, 365 days a year. When you send an instant payment with N26, the recipient receives the money in their bank account almost immediately, making it a convenient way to pay last-minute bills and avoid late fees, or to quickly send and receive money from others.

What is the difference between a bank transfer and an instant bank transfer?

A standard SEPA bank transfer usually takes about 2-3 business days for the money to be available to the recipient. In contrast, an instant bank transfer—also called SEPA Instant Credit Transfer—only takes seconds, so the money is available for the recipient to use almost immediately. Standard SEPA bank transfers are only processed on business days, whereas N26’s instant bank transfers are processed around the clock—24 hours a day, 365 days a year. This means that instant bank transfers can be sent and received by N26 customers at any time, even on public holidays or weekends.

How much does an instant bank transfer cost?

Receiving instant bank transfers—also known as SEPA Instant Credit Transfers—is free for all N26 customers. Sending an instant bank transfer is free for all N26 Smart, N26 Business Smart, N26 You, N26 Business You, N26 Metal, and N26 Business Metal customers. For N26 Standard and N26 Business Standard customers, a €0.99 fee applies. All N26 customers can also use MoneyBeam to instantly pay and get paid from their N26 contacts at no extra cost.

How does MoneyBeam work?

N26 customers can use MoneyBeam to instantly request, send, and receive money from others who also bank with N26, without having to enter their bank details. MoneyBeam is free for all N26 customers. To send a MoneyBeam, open your N26 app and tap on ‘Send Money’, select ‘MoneyBeam’, and follow the prompts. To request money from another N26 customer, tap on ‘Add Money’ then ‘Request from N26 friends’ and follow the prompts.

How can I send money abroad with N26?

N26 has partnered with Wise (formerly TransferWise) to offer easy, fast, and reliable international money transfers in 38 currencies. Simply select ‘Send money’ in your N26 app, then tap ‘Foreign Currency Transfer’. With N26 and Wise, you’ll always get the real market exchange rate, no hidden fees, and full transparency—we’ll show you a detailed overview of the low transfer fee and the exact amount the recipient will get in their bank account before you confirm the international money transfer.

How can I top-up my N26 account?

Once you’ve opened an N26 bank account, you can top up your N26 account instantly with a debit card, credit card, Apple Pay, Google Pay, iDEAL (only in Netherlands), GiroPay (only in Germany), EPS (only in Austria) and Bancontact (only in Belgium). You can also top up your N26 account by requesting money from your N26 contacts via MoneyBeam or making a SEPA bank transfer from another bank to your N26 account.