Love your bank

Welcome to the future of banking — beautifully simple, 100% mobile, and trusted by millions.

The free bank account that makes life easy

Not a fan of hidden fees or paperwork? Us too. Get a bank account with a virtual card and 24/7 support — and manage your money on the go.

Waiting list

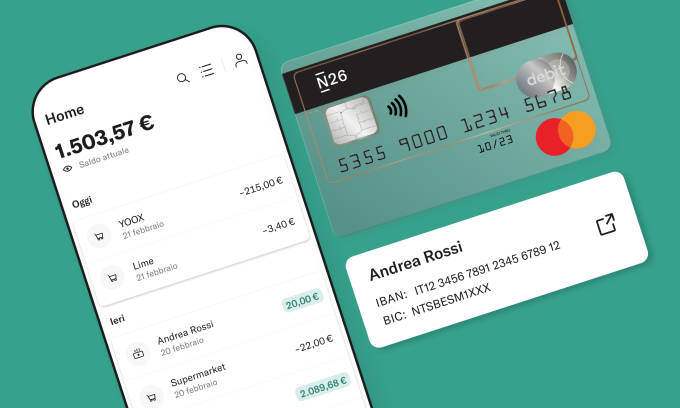

Everyday banking with an Italian IBAN

Dreaming of managing all your payments from one streamlined app? We hear you—which is why we built a bank that brings your finances to your fingertips.

From utility bills to memberships to streaming services and more—all direct debits are free with N26. Plus, you can make bank transfers in seconds, and pay postal bills, MAV or RAV, car taxes, and PagoPA with just a few taps.

Join the bank recognized by Forbes

With cutting-edge service and a world of customer benefits, it's no wonder Forbes named us among the best banks in Italy—and the world. With N26, you get 100% mobile banking with no hidden fees—plus a free physical or virtual Mastercard debit card, free mobile payments with Google Pay and Apple Pay, and Customer Support 7 days a week.

Get Insights into your spending habits

Not sure where all your money's going? Our Insights feature automatically categorizes your spending in real time. Track regular expenses, keep a pulse on your costs, and spot opportunities for savings. Everyday budgeting has never been easier.

Learn about budgeting

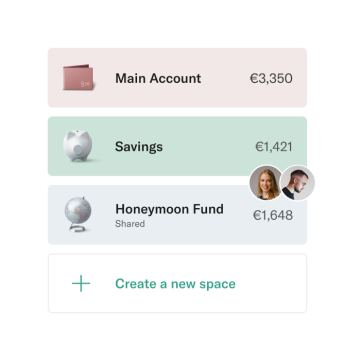

Make your dreams a reality

Your dreams are big—they need some space. Enter N26 Spaces, sub-accounts built for your unique savings goals. Whether you're saving up for a vacation, a new car, or simply create a space for your goal with just a few taps and start saving right away.

Want to save together with family and friends? Then try Shared Spaces—the perfect way to manage your expenses and save with others. Invite up to 10 N26 customers to join a space to stash money for rent, bills, or a weekend getaway—whatever you like!

Shared Spaces

Make payments the easy way with Apple Pay

Tired of carrying your wallet around? We get it—which is why you can link your N26 Mastercard to Apple Pay for effortless payments right from your smartphone. Apple Pay lets you make secure, contactless payments online, in stores, or even in-app. Each transaction is verified by touch or face ID, and takes place in real-time. It’s the simple, safe, 100% mobile way to pay.

Try Apple Pay

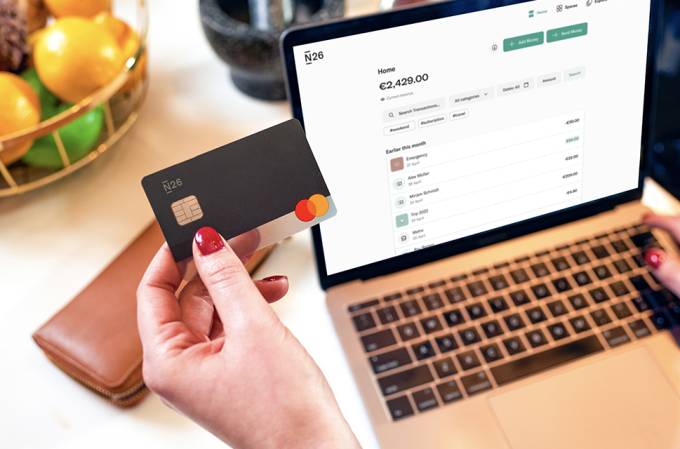

A business account built with you in mind

When you’re a freelancer, the right tools make all the difference. That's why our N26 Business accounts come with everything you need to manage your finances, so you can focus on what you do best. Get up to 0.5% cashback on all purchases and priority Customer Support access, 7 days a week.

Looking for a premium experience? Then try N26 Business Metal, complete with an exclusive metal Mastercard, and extensive travel and pandemic insurance.

Security is a top priority at N26

Your N26 account comes with three-tier security measures that protect all your transactions. Mastercard 3D Secure adds an extra layer of protection when making online payments for extra peace of mind. You can also block your card instantly if it gets lost or stolen, and set your own withdrawal and payment limits right from your N26 app.

N26 is a fully licensed German bank with a European banking license, so your money is always protected up to €100,000 by the German Deposit Protection Fund.

Find out more about security at N26

Get the support you need, 7 days a week

Need assistance? Our N26 Customer Support team is available every day from 7:00 a.m. to 11:00 p.m. CET. Reach out to an N26 expert via the in-app chat feature or via the web app.

N26 Smart, N26 You, or N26 Metal customers can also contact us directly via phone.

Visit our Support Center*The “N26 Standard” current account includes zero fees for the maintenance of the account, the issuance of a virtual debit card and the authorization of virtual debit card transactions, ordinary SEPA transfers in Euros, standing transfer orders, SEPA direct debits, three cash withdrawals a month at ATMs in Euro area. Fees and charges are applicable for services other than those indicated. For the complete contractual and economic conditions, see the information sheets.

Advertising message for promotional purposes. Please see the Terms & Conditions for more information.