N26 Metal

The ultimate bank account with a statement metal card

Make a statement with N26 Metal, and enjoy a new generation premium banking experience with zero fees abroad, an extensive insurance package—including phone coverage—and a world of extra benefits.

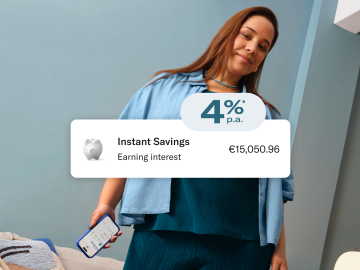

Start earning interest

No deposit limits,** simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.

N26 Metal customers enjoy our highest interest rate: 4%* p.a. It’s yet another benefit of our most premium bank account.

More about the Instant Savings account

A unique N26 Metal debit card

N26 Metal’s Mastercard debit is crafted in 18-grams of stainless steel, and is available in three distinct metallic shades. Standing for the ultimate in premium banking, the engraved card offers minimalist design, along with all the contactless functionality you need.

The easy way to save on crypto fees

N26 Metal is easy on the eyes and an easy way to save on crypto fees. With a Metal account, you get an exclusive discount on N26 Crypto trading fees — pay 1% for Bitcoin and 2% for other coins.***

Learn moreThe market for crypto assets constitutes a high risk. A complete loss of capital is possible at any time.

N26 Crypto is powered by Bitpanda Asset Management GmbH.

Fee-free ATM withdrawals worldwide

Pay with your N26 Metal Mastercard online and in stores, avoiding hidden fees and benefiting from zero foreign transaction fees worldwide. You can also withdraw cash for free in any currency from ATMs worldwide.

Mobile phone insurance

We've all been there, but losing your smartphone doesn't have to be a big deal. Yet, with N26 Metal, your phone is covered in case of theft or damage up to €2,000*. It doesn’t even matter if you paid for your phone with your N26 debit card or not.

Stay on top on your finances with Spaces sub-accounts

Open up to 10 Spaces sub-accounts with IBANs in seconds, and effortlessly organize your money. Instantly put money aside from your main account, then create standing orders for recurring payments, send and receive SEPA transfers, or pay bills via direct debit—right from each space.

Plus, enjoy premium features such as Shared Spaces to manage money together with others, and try Round-Ups to save up the spare change whenever you pay by card. Staying on top of your finances has never been easier.

Discover SpacesPersonal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Emergencies when traveling

The N26 You policy provides cover for you, your spouse and children in case of a medical emergency abroad, including emergency dental care. You also get access to 24/7 medical phone assistance.

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

Exclusive rewards, suited to your lifestyle

Enjoy access to hand-picked deals and selected discounts from world-renowned partner brands—all chosen with modern lifestyles in mind. With N26 Perks, benefit from an ever-growing range of offers from the likes of WeWork, Hotels.com, GetYourGuide, and many more. For more information on what’s currently available to you—as well as how to redeem your deals—please check your N26 app.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Priority Customer Support

We’re always on-hand to help! Need a quick answer or urgent technical support? With N26 Metal, get access to a dedicated Customer Support specialist and speak to them via the phone, or chat to us directly in the app.

Visit our Support Center

A backup for your Metal card

A Mastercard made of metal is a special thing, and losing it is frustrating. That’s why it’s a good idea to get an additional one to rely on in your day-to-day, or if you’re traveling. Simply order an extra card for your Metal account from the N26 You color range.

Read moreFrequently Asked Questions

What are the requirements to open an N26 Metal account?

You can sign up to N26 Metal if you meet the [eligibility criteria]. There are no other requirements or a minimum deposit needed to open this account.

What do I need to open my N26 Metal account?

To open an N26 Metal account, you must meet the eligibility criteria. You can then register on our website or from the N26 mobile app. Sign up only takes a few minutes, and no paperwork is needed. Once your identity is verified, you’ll be able to start using your bank account.

You can find more information at our Support Center.

How do I get an N26 Metal debit card?

When you open your N26 Metal account via the website or app, you can choose the color of your metal Mastercard. This step takes place before identity verification. Once your identity has been verified, we’ll send your N26 Metal card to your delivery address.

To learn more about N26 Metal card delivery, head over to this article in our Support Center.

How many free ATM withdrawals can I use each month with N26 Metal?

If you opened your account in Germany, Austria, Italy, Spain or France your N26 Metal Mastercard debit allows you to enjoy up to 5 fee-free ATM in the country. If you go over this fee-free limit, you’ll have to pay €2 for every additional withdrawal.

Elsewhere in the Eurozone, and just like with all foreign currency payments, all ATM withdrawals are free and unlimited with N26 Metal.

What are the insurances included with this premium account?

N26 premium accounts include:

- Travel delays

- Baggage delay

- Baggage coverage

- Emergencies while traveling

- Trip cancellation

- Trip interruption

- Personal liability insurance

- Mobile phone coverage

- Purchase protection

To learn more about the Allianz Assistance package, please read the Terms and Conditions.

What extra insurance do you get with N26 Metal?

Alongside the insurance package available with N26 You, N26 Metal also gives you additional mobile phone and purchase protection insurance.

Do I have to pay additional fees to benefit from the mobile phone insurance?

No, mobile phone insurance is already included in your monthly N26 Metal membership fee.

What are the other benefits of an N26 Metal account?

N26 Metal also offers unlimited ATM withdrawals in foreign currencies, as well as free card payments worldwide. On top of this, your premium account gives you access to unique Experiences and hand-picked partner offers.

How much does the N26 Metal bank account cost?

The N26 Metal account costs €16.90 per month, with a 1-year commitment period.

What are Spaces sub-accounts, and how can I use them?

N26 Spaces are sub-accounts that sit alongside your main account, giving you an easy way to manage your finances. As a premium customer, create up to 10 Spaces sub-accounts with IBANs in an instant, and effortlessly put money aside for your savings goals, upcoming expenses, or even an emergency fund. Of course, how you use your spaces is up to you—it’s not necessary to add an IBAN to each space if you don’t need one.

With unique IBANs for each Spaces sub-account, you can receive SEPA bank transfers and pay via direct debit—right from each space. Try using Rules to automatically set your bill money aside to a space, then pay via direct debit from your sub-account. With your monthly expenses taken care of, you can relax knowing that you won’t overspend in your main account.

If you want to save and spend as a group, simply create a Shared Space, and manage funds together with up to 10 other N26 customers. However, please note that an IBAN cannot be added to a Shared Space for now. Stay tuned for more updates to come! Find out more about Spaces and Shared Spaces here.

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal. The interest rates are variable and subject to change in the future. Interest rates p.a. are equivalent to AER in Ireland and TANB in Portugal (before taxes).

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

****The N26 Metal crypto fee discounts only apply to trading amounts up to €5,000 (including fees on purchasing and excluding fees on selling crypto) per calendar month. Above this amount, standard fees apply: 1.5% on Bitcoin and 2.5% on all other coins (fees are always rounded up to the nearest full cent — to a maximum of one cent — which may lead to a slight increase of the fee percentage shown in the order preview. Deviations for special coins are possible). The fees and cryptocurrency prices shown on the N26 app for every transaction, including a possible spread, are not determined by N26 but provided by Bitpanda GmbH. N26's liability is expressly excluded for any claim or damage arising from the formation of the prices of the assets offered by Bitpanda.

Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 Metal features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C S.A. - Dutch branch)

Legal Notice: You can see all the information you need to start a claim or call Allianz Global Assistance Europe in case of an emergency in the N26 app. N26 Metal features comprehensive insurance coverage from Allianz Global Assistance Europe (trade name of AWP P & C S.A. - Dutch branch)