Risk indicator for all N26 accounts.

1/6

1/6 This number is indicative of the risk of the product, 1/6 being indicative of lower risk and 6/6 of higher risk.

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Saving and budgeting with others, made easy

Managing household bills and everyday expenses, or simply saving up together for that dream purchase? Invite up to 10 participants to your shared sub-account, and enjoy a hassle-free way to organize money with partners, family or friends.

Save your way with Rules and Round-Ups

Customize how you save. Schedule transfers between your main account and your spaces with Rules—just set the amount and frequency, and we’ll take care of the rest. Thanks to Round-Ups, you can also round-up your card purchases to the nearest euro, and stash the difference in a chosen space.

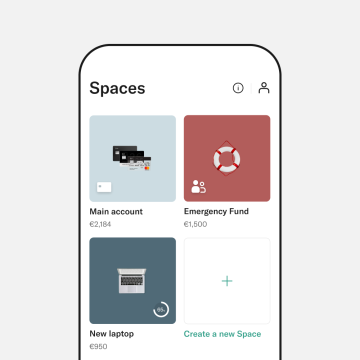

Discover Spaces

One space for collective saving and spending

Shared Spaces is a simple, flexible way to manage money with others. Compare our premium plans to open a bank account best suited to you, and start saving and budgeting from your smartphone.

Frequently asked questions

What is Shared Spaces?

Shared Spaces are sub-accounts that sit within N26 Spaces, accessible via the N26 app and WebApp.

As a premium customer, you can create a sub-account and share it with up to 10 other N26 users. Invite your partner, friends, roommates and family as participants to save and spend together from the same sub-account. Each person can then easily transfer money between the shared space and their own N26 account, and even keep track of all transaction activities just by viewing the space details.

Who owns the money in Shared Spaces?

In order for multiple users to have full access to the same sub-account and the money within it, Shared Spaces uses a Power of Attorney legal model. This means that the premium account holder that originally created the shared space is the sole owner of the space. They grant Power of Attorney to the other participants, giving them permission to transfer money in and out.

The owner of the space can review this “Terms of Use” screen before they invite other N26 users to join. You can also access this when a participant accepts an invitation to join a shared space. You can find these full Terms of Use here.

Can I create Shared Spaces with a free N26 account?

No, you can't access this feature with a free bank account—only premium customers can create and participate in Shared Spaces. Once you’ve been granted Power of Attorney and get access, you’ll be able to move money in and out of that sub-account.

How do I open a Shared Space?

If you already have a premium account with N26, you can open your N26 app and go to the Spaces section in the bottom navigation bar. Create a space, give it a name and set a goal amount. Then, tap Add new participant in the space settings, and follow the steps to send an invitation to an N26 user that has their visibility switched on.

Once they accept your invitation to join the space, the new participant will be allowed to transfer money in and out of the space. And that’s it!

Can you open a Shared Space without the other person being present?

Yes, absolutely! The beauty of Shared Spaces is that it’s all managed through each individual’s N26 account. If you’re a premium customer, create a shared space and invite up to 10 other participants at any time. They’ll receive a notification of your invitation, and once they confirm or decline the invite, N26 will also let you know that this has happened.

How do I remove someone from Shared Spaces?

Since the owner of the shared space grants Power of Attorney to the other participants, they are the only one who can add or remove participants from that space. To do so, head to the shared space, open the space details and you will see its list of participants. Tap on the name of the participant you wish to remove, and confirm.

What do I need to open a Shared Space?

Only N26 premium customers can create and be invited to join a shared space. However, if you’re an N26 Standard customer who opened an account before 16/02/2021, you may also be invited to join and participate in a shared space.

To be invited, make sure you have your visibility switched on—you can do this in your N26 app under My Account > Settings > Personal Settings > Personal Information.

What is the difference between a joint bank account and N26 Shared Spaces?

With a traditional joint account, the two people who open the account do this together, and then have legal equal ownership of it. The difference with Shared Spaces is that the N26 premium user who creates the space is the sole owner of the space. Anyone they invite to join is merely being given Power of Attorney, which allows them to access and/or contribute to the funds within that space.

Shared Spaces is the perfect solution for those looking for a simple, flexible and secure way to manage money together. Whereas joint accounts are often limited to just 2 people, N26 premium customers can create up to 10 Shared Spaces, invite up to 10 participants per space, and remove participants at any time. You can share your space with anyone you know and trust who has an N26 account, such as partners, family, friends, roommates and colleagues. Read more about how it works here.

How can I become visible so that I can participate in a Space?

You can do this directly in your N26 app. Go to the My Account section, open Settings, then tap on Personal Settings. Head to Personal Information and tick the box to confirm that you agree to be identifiable to other N26 users.

What are the benefits of using the free checking account?

Your N26 Standard bank account is 100% mobile and free of charge, adding extra flexibility and convenience to your everyday. No more visiting bank branches, waiting in queues, or inconvenient opening hours. You can send, receive, and manage your money all in one app for free—from anywhere, at any time.

You’ll get a free Mastercard virtual card to pay with your smartphone in-stores, online, and in apps using Apple Pay or Google Pay. You can also withdraw cash for free 3 times per month at any NFC-enabled ATM with the contactless symbol. Plus, enjoy learning about your spending habits with Insights, a smart tool that automatically categorizes your spending in real time.

Which Spanish bank can I switch from?

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.