Risk indicator for all N26 accounts.

1/6

1/6 This number is indicative of the risk of the product, 1/6 being indicative of lower risk and 6/6 of higher risk.

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Compare N26 bank accounts in Spain

Find the perfect plan for you

Find the perfect plan for your business

N26 Standard

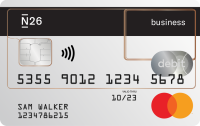

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

*Please note that interest rates for each type of membership are subject to change.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

Services and Fees are for anyone who registers with an address in Belgium, Estonia, Finland, Greece, Ireland, Lithuania, Luxembourg, The Netherlands, Portugal, Slovakia, Slovenia, Sweden, Norway, Denmark, Poland, Iceland and Liechtenstein.

For our detailed price list, view PDF here

For more information on Allianz Assistance insurance coverage, please see the General Conditions of the N26 You, N26 Business or N26 Metal account.

Smart: TIN 0%, APR: -1.17% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €4,90/month. The settlement of the account is made monthly.

You: TIN 0%, APR: -2.35% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €9,90/month. The settlement of the account is made monthly.

Metal: TIN 0%, APR: -3.98% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €16,90/month. The settlement of the account is made monthly.

__*2.26% AER (2.26% annual NIR). With this interest rate, if you maintain a daily balance of €15,000 in your Instant Savings account for a period of 12 months, you’ll earn a total gross interest of €339. Applies to all your savings, no maximum limit. __

Bank Account for Freelancers FAQ

What are the eligibility requirements for N26 Business?

To open the N26 bank account for freelancers you must:

- use the account primarily for business purposes

- not be already an N26 user

- reside in a country where N26 Business is available: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia and Switzerland.

How do I open an N26 Business account?

To open an N26 Business account, you must meet our eligibility criteria. If you do, simply register on our website, or by downloading the N26 app onto a compatible smartphone. Opening an account takes only a few minutes and is done without paperwork. Once you’ve verified your identity, your bank account will be ready to use.

For more information on opening an N26 You bank account, as well as the documents that you need, visit our Support Center.

Do I need a business bank account if I’m self-employed?

The N26 Business bank account is designed precisely for freelancers and self-employed, and you have to use your personal name and surname. A business bank account is a smart and efficient way to separate your personal spending from your business.

Should I open the account with my personal name or with my business name?

To sign up for N26 Business you have to use your personal name and surname. The N26 Business account is designed for self-employed and freelance users doing business under their own name. That means you can’t have your company’s name on the account or card.

Are there any additional fees for using my N26 account to make and receive Social Security payments?

There are no additional fees for having your Social Security benefits paid into your N26 account or for paying your monthly social security contributions as a freelancer.

Can I have an N26 personal and Business account at the same time?

Currently, it's not possible to hold an N26 Business and personal account simultaneously. Given this, if you plan to use your account for business purposes, we recommend opening an N26 Business account from the start. If you want to switch from a Business to a personal account, or visce verse, you'll need to close your current account and open a new one.