Risk indicator for all N26 accounts.

1/6

1/6 This number is indicative of the risk of the product, 1/6 being indicative of lower risk and 6/6 of higher risk.

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

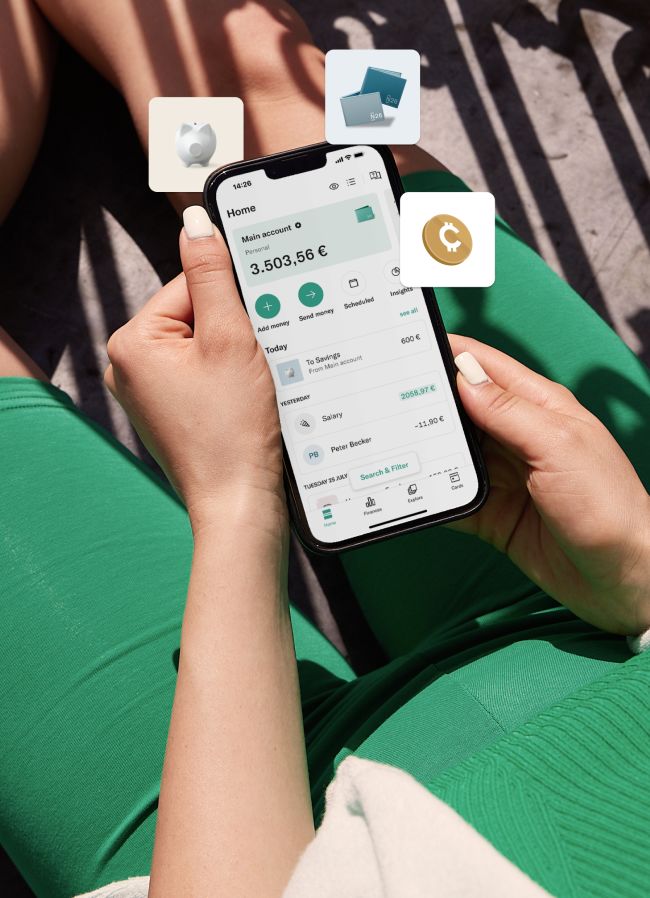

The bank you’ll love

Money made beautifully simple. Spend, save, budget, and invest in one intuitive app that's trusted by millions.

The free bank account for your day-to-day life

Say goodbye to paperwork and hidden fees with N26. Enjoy a completely free and transparent online bank account that fits your lifestyle. Get a Spanish IBAN, Bizum, Customer Support seven days a week, and much more.

Open N26 Standard AccountGrow your savings by 2.26% AER — only with N26

With N26 Instant Savings, your savings can earn you interest — and you can still dip into it whenever you need. Join N26 and start growing your savings:

- 2.26% AER* interest calculated daily, paid monthly

- No minimum or maximum deposit limits

- No conditions or fees

- Instant access

- Available with free and premium N26 bank accounts

Bizum and SEPA

Pay friends and make transfers within the Eurozone the quick way.

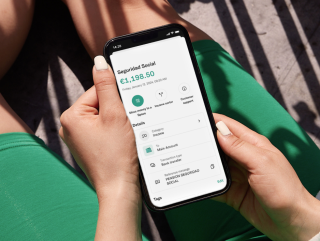

Social Security

Collect your benefits and pay self-employment fees with your N26 account.

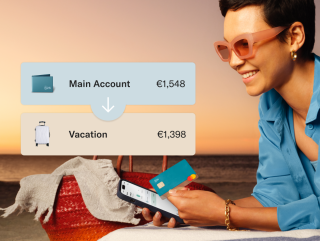

N26 Spaces

Not a fan of paperwork? Spend, budget, and save right from your phone.

Joint Accounts

Manage your shared finances comfortably with a free account with a unique IBAN.

Invest in cryptocurrencies — right in your N26 app

Buy and sell cryptocurrencies with N26 Crypto conveniently and easily — no need to download another app. Choose from nearly 200 coins like Bitcoin, Ether, and Cardano, and start investing from as little as €1. You'll pay just 1.5% commission on Bitcoin and 2.5% on all other cryptocurrencies (or less, if you switch to N26 Metal)**.

Take a lookN26 accounts — your money deserves an upgrade

N26 Metal

The premium account with a metal card

- 2.26% AER* interest on your N26 Instant Savings

- Up to 10 Spaces and 8 free domestic ATM withdrawals

- Extended travel, phone, and purchase protection insurance

- 18-gram metal card

N26 You

The debit card for everyday and travel

- 2.26% AER* interest on your N26 Instant Savings

- Up to 5 free domestic ATM withdrawals

- Up to 10 Spaces sub-accounts

- Travel insurance

N26 Smart

The bank account that gives you more control

- 2.26% AER* interest on your N26 Instant Savings

- Up to 10 Spaces sub-accounts

- Customer support hotline

- Virtual and physical card

N26 Standard

The free online bank account

- 2.26% AER* interest on your N26 Instant Savings

- Worldwide payments and no foreign transaction fees

- Up to 3 free domestic ATM withdrawals

- Virtual debit card

For more information on the N26 membership plans and Allianz Assistance insurance coverage, please see the plan comparison page and the applicable T&Cs.

Refer your friends and earn up to €1,500

Already an N26 customer and like us so much that you'd recommend us? Log in to your N26 app, tap on your profile and scroll down to 'Useful actions,' then select 'Invite your friends.' Share your code with anyone you want, and once your friends open their N26 account and spend €10, you'll both receive your reward.

Invite friends

What you need to open your N26 account

To make things easier for you, we've put together a quick overview of the documents you need to open your N26 account according to your nationality.

See list of documents*N26 Instant Savings account from €0 and with no amount limit. 2.26% AER (2.26% annual NIR). At this interest rate, if you maintain a daily balance of €15,000 in your N26 Instant Savings account for a period of 12 months, you'll earn a total gross interest of €339. Interest settled monthly. Applicable to any amount deposited in the Instant Savings account, with no maximum limit. See conditions at https://www.n26.com

** Investing in crypto-assets is not regulated, may not be suitable for retail investors, and the full amount invested may be lost.

N26 Standard: No account opening, administration or maintenance fees. No deposit or direct debit conditions. See conditions at www.n26.com. 0% TIN, 0% AER.

N26 Smart: TIN 0%, APR: -1.17% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €4,90/month. The settlement of the account is made monthly.

N26 You: TIN 0%, APR: -2.35% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €9,90/month. The settlement of the account is made monthly.

N26 Metal: TIN 0%, APR: -3.98% for a scenario in which a daily balance of €5,000 is maintained consistently for 1 year, applying an annual nominal interest rate of 0% and the monthly cost of the account of €16,90/month. The settlement of the account is made monthly.

Is N26 a bank?

N26 operates with a full European banking license, which protects deposits up to €100,000 under EU law. We currently operate in 24 markets worldwide and have over 8 million customers.

Is N26 secure?

N26 operates with a full European banking license, which protects your money up to €100,000 under EU law. With features like 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, we make your security our top priority.

How is N26 protecting my money and personal data?

As a bank, N26 is supervised by the Financial Markets Regulator and meets all European regulatory requirements. Our clients' funds are guaranteed up to €100,000 by the Deposit Protection Fund. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

Does N26 offer a Spanish IBAN?

All N26 accounts opened after April 17, 2019 have a Spanish IBAN. This means that, in addition to using your account to withdraw money or make card payments, you can also use it to deposit your salary, direct debits or to manage your daily expenses from the app. Enjoy all the advantages of a 100% mobile account with a Spanish IBAN.

What do you need to open a bank account?

To open an N26 bank account, you must meet the eligibility criteria and an official identity document accepted in the country where you live. If you do, you can simply register via the N26 WebApp on desktop or the N26 app on your smartphone. It only takes a few minutes to open a bank account, and there’s no paperwork involved. You can start using your account right away once your identity is verified.

How much does it cost to open a bank account?

N26 Standard is a free bank account. There are no account maintenance fees or minimum deposit amounts for this online account. N26 Smart, You, and Metal premium accounts cost a monthly fee. Visit our website for more information and to compare accounts.

Which Spanish bank can I switch from?

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.

What does “risk level of the product” mean?

In Spain, the risk level of investment products is measured on a numerical scale from one to six. This means that the products marked as 1/6 are considered the safest, and those with 6/6 carry the most risk. As N26 is a member of the Deposit Guarantee Fund for Credit Institutions in Spain, all funds deposited into your N26 bank account — including Instant Savings — are always protected up to €100,000.