Compare N26 bank accounts in Switzerland

Find the perfect plan for you

N26 Smart

The bank account with tools for spending and saving

€4.90/Month

Find the perfect plan for your business

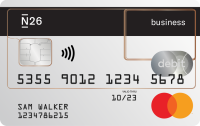

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

Services and Fees for everyone who registers with an address in Switzerland.

For our detailed price list, view PDF here

Personal Bank Account FAQ

How do I open a free bank account at N26?

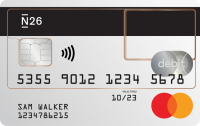

It’s simple—first make sure that you meet the requirements to open an account. You have to be over the age of 18, live in one of the eligible countries, and not have a different N26 account already. Of course, you should also have a compatible smartphone. Apart from that, you just need an ID and a few spare minutes. Download the N26 app to open your free bank account, or use the N26 WebApp. As soon as you’ve opened your account, you’ll receive your virtual Mastercard and you’ll be up and running!

What is the N26 bank account (euro account) for Switzerland?

The free bank account from N26 is a free euro account for anyone living in Switzerland who’d like to have a bank account in euros. N26 is a German bank and you’ll get a German IBAN, a virtual Mastercard, and benefit from other smart money management features. Open your account directly on your smartphone in just a few minutes.

Can I have both a regular N26 bank account and an N26 Business bank account at the same time?

No. It currently isn’t possible to have two N26 bank accounts with the same name. If you have a personal N26 account and want to open an N26 Business bank account, you will first need to close your personal N26 bank account. You may then sign up for an N26 Business Smart bank account.