Compare N26 bank accounts in Austria

Find the perfect plan for you

Find the perfect plan for your business

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

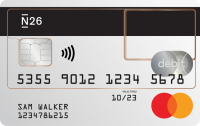

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

Personal Bank Account FAQ

What documents do I need to open a bank account?

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved—just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

How much does a N26 bank account cost?

The Standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €9.90 per month, the N26 You bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month, with a 12-month commitment period. To open an N26 account, no deposit or minimum income is required.

How old do you have to be to open an N26 bank account?

You’ll need to be at least 18 years old to open a bank account with N26.

What do I need to do to switch bank accounts?

Simply visit the Qwist website and follow the instructions. Qwist will then contact all relevant parties and automatically transfer direct debits, standing orders, and incoming transactions for you.

Alternatively, you can switch bank accounts yourself by sending the details of your new bank account to any relevant parties.

What’s the difference between a personal bank account and a business one?

The major difference between a personal bank account and a business account is what it’s used for. As the name suggests, personal bank accounts are designed for personal, day-to-day use. Conversely, business accounts are only intended for business transactions. A business account gives you a better overview of your business expenses and enables you to store the relevant receipts more easily. This blog post tells you more about the differences between these two kinds of accounts.

Can I have a personal and business account at the same time?

You can’t have two bank accounts with N26 at the same time. If you already have an N26 account but would like to open up an N26 business account, you’ll have to close your personal account first. Then you can open a business account through the N26 app or our website.

*Please note that interest rates for each type of membership are subject to change.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

Services and Fees for everyone who registers with an address in Austria.

For our detailed price list, view PDF here

For more information on Allianz Assistance insurance coverage, please see the General Conditions of N26 You, N26 Business You or N26 Metal account.